Investment Philosophy

Investopedia (yes…Investopedia) sums this up nicely, “A set of guiding principles that inform and shape an individual’s investment decision-making process.” Within these principles, I broadly categorize them into default positions, malleable positions, and highly malleable positions. I hope to explore each one of these bullet points with an essay. Additionally, this is very much a living document and I anticipate adding and subtracting positions (rarely do I plan to change default positions, however). Most, if not all, of the below are not original thoughts and many luminaries in the investing world have espoused the same principles. (These are not ordered in any particular way…numbering is more for identification purposes “Default Positon, 1” means the first numbered position within the category default positions…Also, the formatting for bulleted lists in WordPress stinks.)

Default Positions

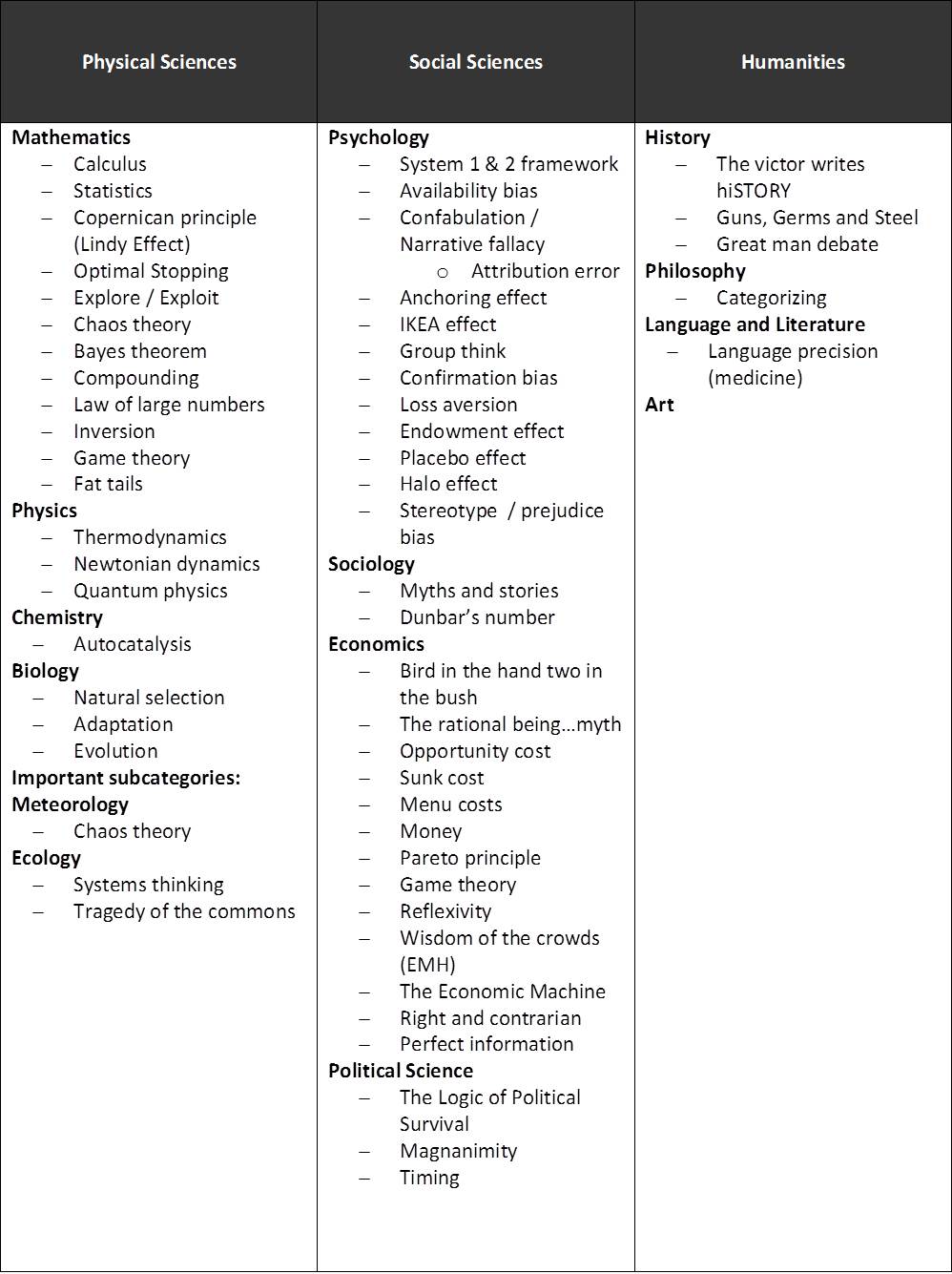

- As you move from the predictability of the physical sciences to the reflexive (using Soros’s definition) social sciences it is impossible to fully untangle and understand the near infinite and constantly changing variables that affect a system. Accordingly, predicting the future is exceedingly difficult and perfectly predicting the future is impossible. Investing fits squarely in the social sciences…as much as the academics desire it to have the precision of physics.

- Many principles of investing fall out from this: margin of safety, the inability to perfectly measure “intrinsic value”, the need for diversification, market / economic cycles, second-order thinking, and why markets are inefficient.

- The value of something, or its intrinsic value, is derived from its future cash flows discounted back to the present…period.

- You must be both right and contrarian to make good investments.

- Being right about the future is difficult, being contrarian is difficult and knowing that your thoughts are actually contrarian is difficult.

- Right for the wrong reasons is not sustainable, but being wrong for the right reasons has a finite lifespan, too.

Malleable Positions

- Risk is the probability of losing part, or all, of one’s principal investment and the opportunity cost associated with the capital one necessarily ties up. It is not volatility.

- The market, through the wisdom of the crowds, is right most of the time, but not all the time.

- While impossible to fully untangle cause and effect and create perfect predictions, the effort in getting close allows one to develop a right, contrarian viewpoint.

- The value of a stock is the discounted future cash flows derived from the business the stock represents modified for whoever makes capital allocation decisions.

- Time to execution (threshold of information needed to make an informed decision) matters a lot

- A targeted return doesn’t make sense without incorporating the rate of inflation and the “risk-free rate.” A 10% absolute return is awful if inflation is 15%.

- Conviction, but intellectual flexibility (to admit you are wrong), is necessary. “Balance arrogance and humility” – Klarman.

- Great business models, or moats, don’t last forever, but they are still worth identifying.

- Rationality in thought is more important than raw intelligence when it comes to investing.

Highly Malleable Positions

- “Pattern recognition” exists to a degree, but some take it too far.

- Staying within a “circle of competence” makes intuitive sense, but also gets taken too far.

- Humans are emotional creatures. Recognize where you and others can/will get in trouble with emotions and protect against it.

- A narrower band of thought on a stock/investment reduces the “power” of the wisdom of the crowds and allows for opportunity.

- In any decision, start with the base rate and augment from there.

- Many times, identifying the base rate is nearly impossible…

- To know the amount of work that needs to be done, figure out where the competitive bar of excellence is and exceed it.

- An investors edge can come from only:

- Informational asymmetry

- Analytical divergence

- Behavioral/structural advantages

- Organizational incentives

- Time horizon

- Liquidity